“You can’t teach an old dog new tricks.” It’s a popular phrase, but in the Age of the Customer small businesses are learning the hard way that their old dogs need to learn some new tricks — and quickly.

In the second century B.C., the Roman statesman, Cato, began learning Greek at the age of 75. When asked why he was undertaking such a challenging educational enterprise at his advanced age, he replied, “This is the youngest age I have.”

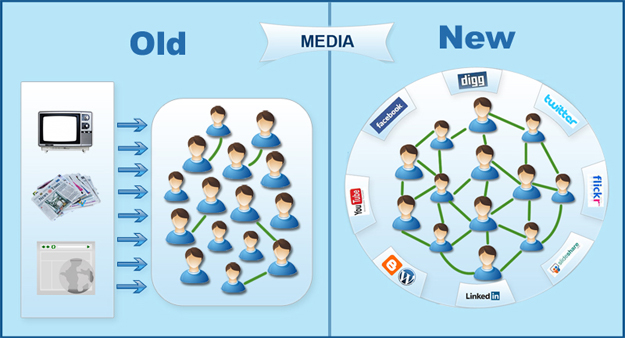

No matter what we do, no matter where we go, owner or employee, we must continue to study, train and learn. Everyone in your organization. Everyone, every day, needs life-long learning. And in the age of globalism and interconnectivity, it is more important than ever before.

No matter what we do, no matter where we go, owner or employee, we must continue to study, train and learn. Everyone in your organization. Everyone, every day, needs life-long learning. And in the age of globalism and interconnectivity, it is more important than ever before.

Are you feeling threatened, maybe even frightened these days with all of the economic challenges, plus the changes brought on by the advent of the information age? Me, too. Sometimes it seems we’re like Alice – running as hard as we can just to stay in one place. And in our Wonderland, everything is changing so fast that what we learned today may be obsolete tomorrow.

The irony is the thing creating so much potential for anxiety is also the thing that can help you stay competitive. That thing is called technology. Specifically, the unprecedented wealth of information available on the Internet.

When I feel threatened by all of the new knowledge and capability that’s emerging, I just make a point to learn something new every day, with emphasis on social media and e-commerce, or how my industry is adapting to the virtual marketplace. When I acquire that new understanding or capability, I smile like Alice’s Cheshire Cat because learning makes me feel stronger, as if I’ve gained a little ground in the marketplace. Maybe today I put the heat on a competitor.

Advantage: Me.

Give it a try. The only thing better than your garden variety smile is one that comes from knowing you just got a little smarter.

Remember the wisdom of the statesman: This is the youngest age you have.

It’s your moment of relevance. Take advantage of it.