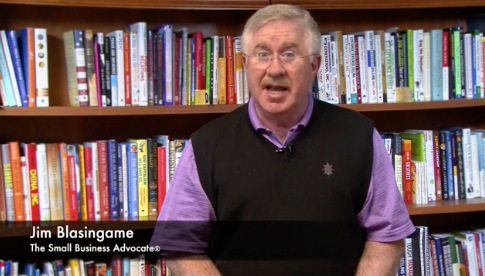

VIDEO: Your future and customer paradigms

Award-winning author Jim Blasingame lists the top three primary shifts of the new age that a small business must monitor constantly in order to be successful in the Age of the Customer. You can purchase his new book The Age of the Customer here .

Click the image to start the video.

Celebrate your customers this week

According to the ICSA, the purpose of National Customer Service Week is “to create a positive message that lasts all year long and to provide a productive opportunity to generate an even stronger commitment to customer service excellence.”

According to the ICSA, the purpose of National Customer Service Week is “to create a positive message that lasts all year long and to provide a productive opportunity to generate an even stronger commitment to customer service excellence.”You should never have “a customer from hell”

“This is one of those customers from hell.”

That’s what a small business owner said to me during one of my road trips across the country to check on how things are going out on Main Street.

“Ann” was responding to my query about her business. Her full quote was closer to, “Business is good. But right now I’ve got to spend most of the day dealing with this customer from hell.”

When I was a pup commission salesman right out of high school working in big ticket retail, I quickly realized all customers aren’t created equal; there are cool ones, high maintenance ones and impossible ones, like the one Ann was fuming about. My initial reaction was I didn’t like the latter two types and would try to avoid them. But upon more mature reflection I realized that if I was going to be successful selling on commission, I would have to do business with all kinds of customers, not just the easy ones. Honing this perspective over time, I developed the twin pillars of Blasingame’s Difficult Customer Strategy.

Pillar One: Make an extra effort to understand what troubles and/or motivates difficult customers and serve them within an inch of their lives. Most difficult customers will give you points for the effort and very likely their business in the bargain. And here’s an extra effort bonus: When a difficult customer likes you, you’ll have a customer for life, and the most valuable referral source.

Pillar Two: The hellish behavior of some customers typically manifests as excessive demands. When dealing with such people, charge them for their behavior. As I told Ann, charge difficult customers enough so that regardless of their level of maintenance, you hope they come back and ask for everything again. The key is to ask enough questions about their expectations before you set your price. Or at least remember the next time.

One former consulting client of mine could be difficult. Whenever we were face-to-face and he showed me his hellish side, I would exaggerate making a mark on my note pad, which he knew was to remind me to add a difficulty factor fee on his next invoice (he had a different name for it that can’t be used here). Eventually we joked about it, but he knew his behavior impacted his bill. He was a client for years and, difficult or not, I always liked his business.

Write this on a rock … You should never have a customer from hell.

Jim Blasingame is the author of the award-winning book, “The Age of the Customer: Prepare for the Moment of Relevance.”

Is a crowdfunding business loan right for you?

In my last column I introduced the concept of crowdfunding — the new word and online methods of fundraising and capitalization. The two crowdfunding examples I described were contributions and business transactions doubling as fundraising.

Let’s continue with the third type, which is, crowdfunding structured for loans.

Crowdfunding debt, AKA peer-to-peer and social lending, is like traditional borrowing: a request for funds comes with the promise of repayment with interest over a specific term. But the former is done online, and the latter is not. Individuals use crowdfunding for personal loans, but our focus here is for business borrowing, which typically involve four crowds:

Crowdfunding debt, AKA peer-to-peer and social lending, is like traditional borrowing: a request for funds comes with the promise of repayment with interest over a specific term. But the former is done online, and the latter is not. Individuals use crowdfunding for personal loans, but our focus here is for business borrowing, which typically involve four crowds:

1. Business borrowers

2. An online crowdfunding platform aggregating loan requests

3. A funding and underwriting source, likely a hedge fund

4. Individuals who invest with #3, knowing it’s for loans to small businesses

Remember the innumerable and anonymous crowdfunding factors from the previous column? These two are also in play with crowdfunding debt, because a large crowd is required to provide a pool of loan funds and dilute the risk, and investors are only known to the funding source aggregator.

Regardless of the funding source, crowdfunding or traditional, small business loans are expensive for the borrower because this sector is considered high risk for two primary reasons:

1. Most small businesses are undercapitalized and operate on a thin survival margin

2. Too many small business owners don’t track financial performance well enough to know how they’re really doing.

And since crowdfunding loans are unsecured, taking the risk to an even higher level, crowdfunding business loans are doubly expensive.

So is a crowdfunding business loan right for you? Here’s some context: If you can borrow from your bank, this year you’ll probably pay an average of about 6% annual interest rate. A crowdfunding loan APR will likely be 15% or more. Any questions?

Crowdfunding business lending has achieved some level of critical mass and is growing. As I’ve said before, the future of small business capitalization will look a lot different than it does today largely due to this emerging alternative.

Next time we’ll wrap up this series with a tour of the good, bad, and improbable of investor equity crowdfunding. And more tough love.

Write this on a rock If you can borrow money from a bank, don’t borrow from a crowd

Jim Blasingame is the author of the award-winning book, “The Age of the Customer: Prepare for the Moment of Relevance.”

Crowd funding is not new, but crowdfunding is

Crowd funding is not new, but crowdfunding is. Completely intuitive, both terms mean funds conveyed by a crowd to a solicitor.

It’s largely due to those two words, innumerable and anonymous, that crowdfunding has caught on to the point where several online platforms now aggregate funds seekers with funding crowds. Now with crowdfunding, the Internet simultaneously facilitates and disrupts our experiences with what I call the Four Cs of Modern Society: Connect, Communicate, Communities and Commerce.

So far, crowdfunding fits primarily into two categories:

This is where an emotional connection motivates members of a crowd to give to a cause, project, idea, ideal, etc. Besides the emotional motivation, merchandise like a T-shirt or first album, for example, are likely to be involved as a token of thanks. This crowdfunding form is nothing more than donations.

Business funding

This money goes to a commercial venture, often a startup, with the expectation of receiving a first-of-its-kind product or future discount. The crowd knows the funds partially pay for the merchandise and partly capitalize the venture to which this crowd also has an emotional connection. This is business funding in the form of a commercial transaction, not investment.

Recently, crowdfunding has nudged closer to debt and equity capitalization. Peer-to-peer lending is an emerging form of crowdfunding, while the investment model still has legal and practical hurdles.

It’s clear that the future of small business capitalization will look a lot different than it does today. But for most small businesses the jury is still out on how the crowdfunding options will be part of their capitalization future.

In my next column I’ll use a practical approach and some tough love to reveal the challenges facing both the debt and equity sides of crowdfunding. Ironically, those two advantages of crowdfunding mentioned earlier, innumerable and anonymous, will manifest as potential barriers as we discuss the more sophisticated forms of crowdfunding.

Write this on a rock…

Crowdfunding is just new tools to accomplish traditional fundraising and capitalization.

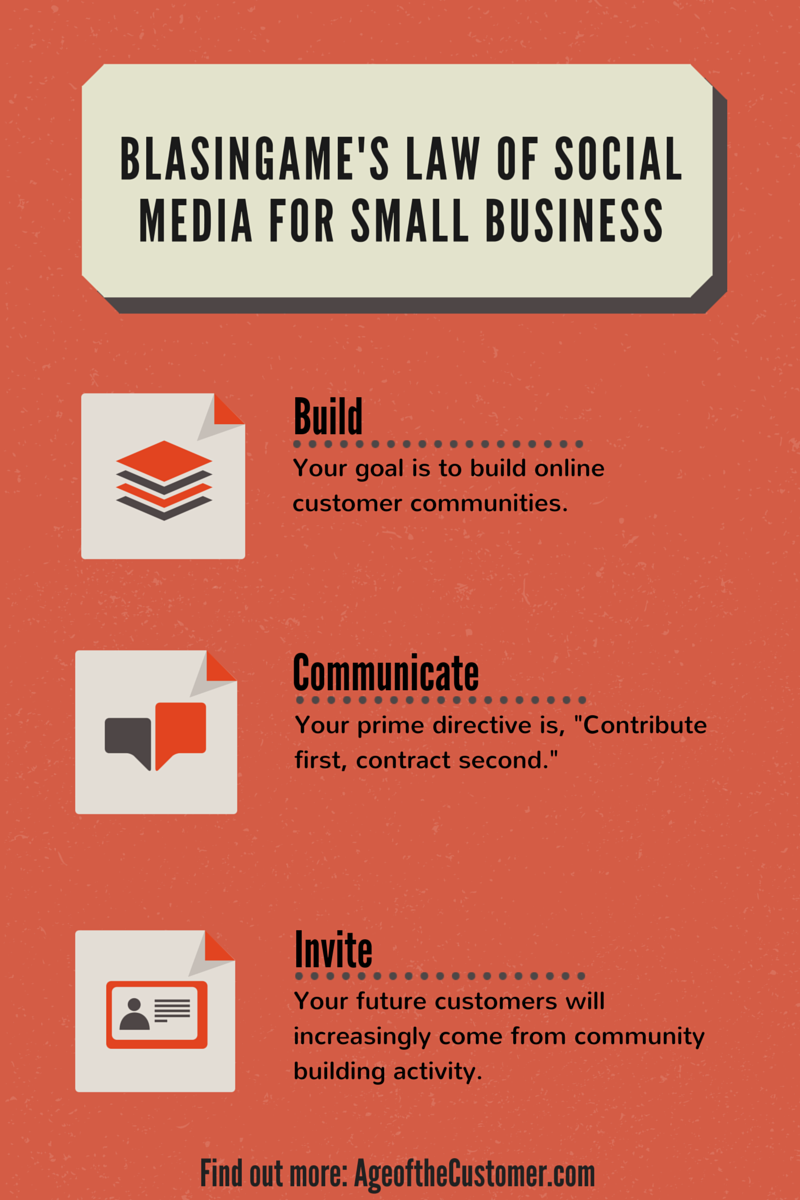

Do you know how customers are finding you?

In the old days, when someone would call or come in the door of your business for the first time, you would ask them how they found you. And since it’s not your customer’s job to catalog such things for future retrieval, you probably had to help them a little by reciting examples of where you might have spent your marketing budget: an ad on the radio, TV, newspaper, Yellow Pages, a Little League uniform, etc.

Here in the second decade of the 21st century, asking how customers find you is still important, but with one new element: For the past 10-15 years, you should also include, “or did you find us online?”

Not too long ago, saying “our website” instead of “online” would have been appropriate. Today, online is best because customers can find you in other places on the Internet, including the social media and customer review platforms, even if, Heaven forbid, you don’t have a website.

Not too long ago, saying “our website” instead of “online” would have been appropriate. Today, online is best because customers can find you in other places on the Internet, including the social media and customer review platforms, even if, Heaven forbid, you don’t have a website.

The question is not whether your company is “out there” online today, but rather to what degree and – this is so important it will be on the test – what is being said about your business.

We wanted to know how much small businesses are attributing sales performance to the Internet, so recently we asked our radio and online audience this question: “How much of your 2011 sales do you think will result from some kind of Internet activity, even as simple as people just finding your business mentioned online?” The results made me very happy. About 90% of our respondents said they would be able to attribute some sales in 2011 from the Internet.

Breaking the numbers down, over 50% said less than half of 2011 sales would be attributed to online activity. The next number is really exciting: About one-fourth said they would see more than half of their sales from the Internet. And finally, the bookends: Those who said all of their sales would come from the Internet were almost the same – around 10% – as those who recorded a goose egg because (read this with a nasal whine), “We don’t have a website.”

As the Age of the Customer™ becomes the marketplace norm, your customers are increasingly demanding more connection and support from you with online resources. Any company that is not making at least some effort to meet the growing online support demand will experience the painful death of irrelevancy.

Write this on a rock … You don’t have to win the online race to be successful, but you do have to show up and compete.

Blasingame’s Law of Sales Pipelines…for businesses

Selling is a numbers game.

A maxim is a generally accepted truth. Calling is selling a “numbers game” is a maxim for two reasons.

1. There are hundreds – if not thousands – of things that can cause a fully qualified prospect to not complete a transaction, at least not on your preferred schedule.

2. Regardless of all of the bumps on the path to a signed contract, it’s still your job to produce enough sales revenue to stay in business.

Enter the sales pipeline, and it’ll all tie together.

A sales pipeline is a planning concept that helps managers and salespeople forecast sales for any given period – week, month, quarter or year. Think of your sales pipeline as overhead plumbing with faucets positioned at the calendar intervals your business requires. From these faucets you draw the mother’s milk of any business – sales revenue.

Pipeline faucets come with screens that only allow a sale to pass through so into the pipeline you load only those prospects you have qualified. That means the prospects that have answered enough questions to allow you to determine that what they want, and your ability to deliver, will combine to produce a faucet-conforming sale within the timeframe or your forecast. Once in the pipeline, a prospect is either on track to become a sale or a forecasting mistake to be removed.

As you record a prospect’s entry into the pipeline you must include what you know about their stage of decision-making, plus what you have to do to move them to customer status. Identifying what’s left to be done with each prospect – demo, trial, proposal, final close, etc. – will help you forecast which faucet –you can expect a sale to pour out of, whether next week or next month.

At this point, let’s refer to The Bard. In Act I, Scene III, of Hamlet, Polonius famously says, “This above all, to thine own self be true.” If you aren’t honest about a prospect’s progress to faucet-conformity, you’re setting yourself up for forecasting failure.

How much revenue you draw from your sales pipeline depends on the twin standards of sales success: quantity and quality.

Here’s Blasingame’s Law of Sales Pipelines: Load the pipeline with enough prospects on Monday (quantity) to have enough qualified prospects to close on Wednesday (quality) so that you can draw the sales you need from your pipeline on Friday (success).

Forecast sales successfully with quantity, quality and to thine own self be true.