This is the second of two articles on small businesses going global.

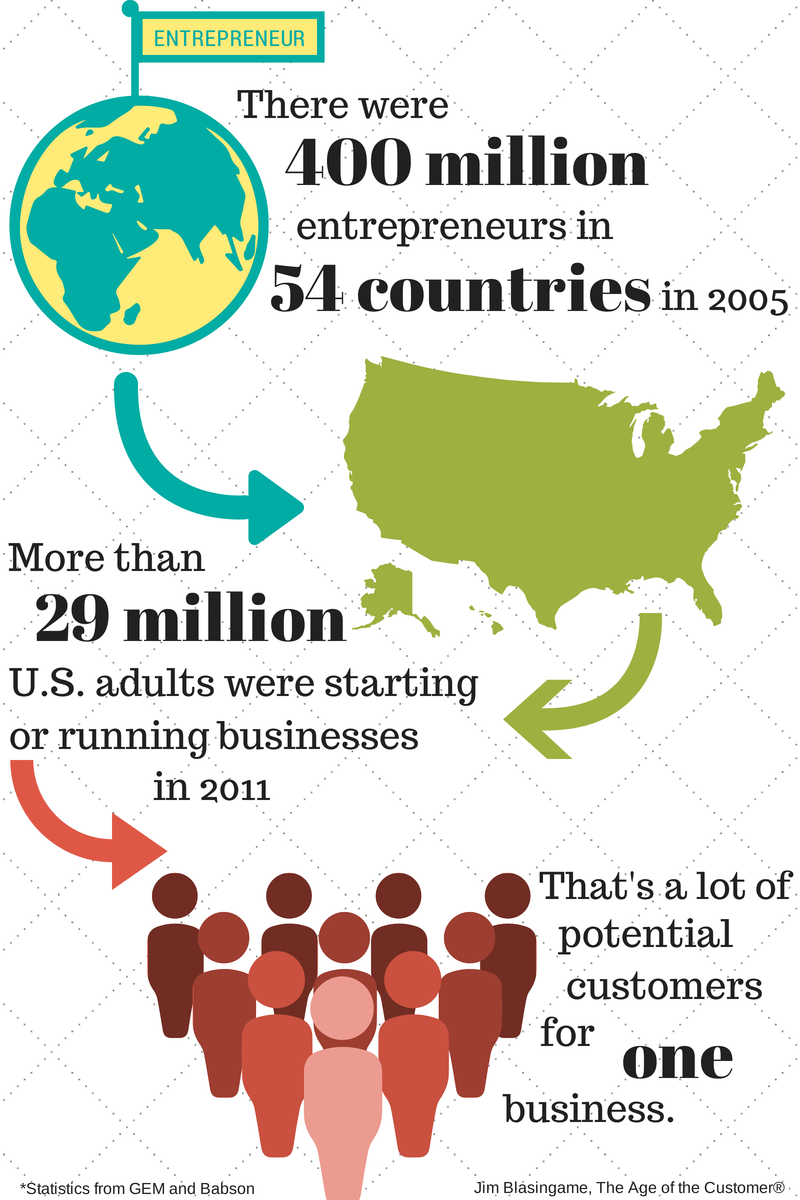

In the first article, I allowed that it can be exciting for business leaders to imagine a global prospect base of more than seven billion people. But for a small business to imagine an export strategy, it’s at once exciting and intimidating because of the three elemental global business questions, the first of which we focused on last time: Who are my global prospects? Now let’s focuses on the other two: How to connect with them and how to get paid.

In the first article, I allowed that it can be exciting for business leaders to imagine a global prospect base of more than seven billion people. But for a small business to imagine an export strategy, it’s at once exciting and intimidating because of the three elemental global business questions, the first of which we focused on last time: Who are my global prospects? Now let’s focuses on the other two: How to connect with them and how to get paid.

The good news is that there are two government agencies standing by to answer both of these questions. Each one provides digital information, human assistance and global networks designed to help a small business maximize its opportunity to create and execute a successful export strategy.

The, “How do I connect with global prospect?” question can be answered by the U.S. Commercial Services, a division of the U.S. Department of Commerce. This should be your first stop for education on finding and converting global prospects into customers.

When you consider all of their resources, the U.S. Commercial Service is a virtual one-stop shop for developing and executing a small business export strategy: a great website (Export.gov); a toll-free number (800-872-872) answered by a real person; over 100 offices around the U.S., plus dozens more around the globe you can walk right into and ask for help; and their book, “A Basic Guide to Exporting,” includes an excellent tutorial and several case studies.

All of that help is free, with the exception of the book and any direct expenses incurred on your behalf.

Export-Import Bank of the United States (ExIm.gov) can answer the “how do I get paid” question on many levels.

Part of the U.S. government, Ex-Im Bank will assist with the financial elements of your export sale. They will working with the banks on both sides of the transaction to coordinate funds transfers, provide loan guarantees, and even pre-delivery working capital for you and post-delivery financing for your customer.

For generations, big firms have owned the franchise on global business. But shifts in technology and demographics are making the global marketplace more compelling and feasible for small businesses.

Contact these two organizations and let them help you develop a global business strategy.

Write this on a rock…The global marketplace – and 7 billion prospects – are waiting for you.