Freedom is not free

Contemplating the blessing of freedom, wherever it may be found, one prime truth is evident: Freedom is not free. And for those of us who are the beneficiaries of those who paid the ultimate price for our freedom, the only method of repayment — the only way we can ever be worthy of their sacrifice — is if we do all we can to maintain the freedom that has been paid for and given to us.

Contemplating the blessing of freedom, wherever it may be found, one prime truth is evident: Freedom is not free. And for those of us who are the beneficiaries of those who paid the ultimate price for our freedom, the only method of repayment — the only way we can ever be worthy of their sacrifice — is if we do all we can to maintain the freedom that has been paid for and given to us.

In honor of all of our veterans, past and present, I’d like to offer this poem written by Commander Kelly Strong, USCG (Ret.) in 1981 when he was a high school senior (JROTC cadet) at Homestead High School, Homestead, FL. It is a tribute to his father, a career marine who served two tours in Vietnam.

Freedom Isn’t Free

I watched the flag pass by one day.

It fluttered in the breeze.

A young Marine saluted it,

And then he stood at ease.

I looked at him in uniform

So young, so tall, so proud,

With hair cut square and eyes alert

He’d stand out in any crowd.

I thought how many men like him

Had fallen through the years.

How many died on foreign soil?

How many mothers’ tears?

How many pilots’ planes shot down?

How many died at sea?

How many foxholes were soldiers’ graves?

No, freedom isn’t free.

I heard the sound of taps one night,

When everything was still

I listened to the bugler play

And felt a sudden chill.

I wondered just how many times

That taps had meant “Amen,”

When a flag had draped a coffin

Of a brother or a friend.

I thought of all the children,

Of the mothers and the wives,

Of fathers, sons and husbands

With interrupted lives.

I thought about a graveyard

At the bottom of the sea

Of unmarked graves in Arlington.

No, freedom isn’t free.

My friends, I pray that we never forget those who paid so dearly for our freedom. Have a safe, happy and respectful Veterans Day.

Thanks for being part of my community. I’ll see you on the radio and the Internet.

You should never have “a customer from hell”

“This is one of those customers from hell.”

That’s what a small business owner said to me during one of my road trips across the country to check on how things are going out on Main Street.

“Ann” was responding to my query about her business. Her full quote was closer to, “Business is good. But right now I’ve got to spend most of the day dealing with this customer from hell.”

When I was a pup commission salesman right out of high school working in big ticket retail, I quickly realized all customers aren’t created equal; there are cool ones, high maintenance ones and impossible ones, like the one Ann was fuming about. My initial reaction was I didn’t like the latter two types and would try to avoid them. But upon more mature reflection I realized that if I was going to be successful selling on commission, I would have to do business with all kinds of customers, not just the easy ones. Honing this perspective over time, I developed the twin pillars of Blasingame’s Difficult Customer Strategy.

Pillar One: Make an extra effort to understand what troubles and/or motivates difficult customers and serve them within an inch of their lives. Most difficult customers will give you points for the effort and very likely their business in the bargain. And here’s an extra effort bonus: When a difficult customer likes you, you’ll have a customer for life, and the most valuable referral source.

Pillar Two: The hellish behavior of some customers typically manifests as excessive demands. When dealing with such people, charge them for their behavior. As I told Ann, charge difficult customers enough so that regardless of their level of maintenance, you hope they come back and ask for everything again. The key is to ask enough questions about their expectations before you set your price. Or at least remember the next time.

One former consulting client of mine could be difficult. Whenever we were face-to-face and he showed me his hellish side, I would exaggerate making a mark on my note pad, which he knew was to remind me to add a difficulty factor fee on his next invoice (he had a different name for it that can’t be used here). Eventually we joked about it, but he knew his behavior impacted his bill. He was a client for years and, difficult or not, I always liked his business.

Write this on a rock … You should never have a customer from hell.

Jim Blasingame is the author of the award-winning book, “The Age of the Customer: Prepare for the Moment of Relevance.”

Dispelling the myths of ownership

As the economy recovers, you’re likely to meet a starry-eyed human babbling on about becoming a business owner.

Probing for the object of this person’s entrepreneurial infatuation will precipitate the what, where, how and when questions and, finally, the most important question: Why do you want to own a business? Answers to this last question, unfortunately, often produce what I call “The Myths of Small Business Ownership.” Here are four:

Myth 1: When I’m an owner, I’ll be my own boss.

That’s right; you won’t have an employer telling you what to do. But you’ll trade that one boss for many others: customers, landlords, bankers, the IRS, regulators, even employees.

Modern management is less “bossing” and more leading and inspiring. In a small business, everyone must wear several hats and the dominator management model doesn’t work well in this modern multi-tasking environment.

Myth 2: When I own my own business, I won’t have to work as hard as I do now.

This is actually true – you will work much harder. Ramona Arnett, CEO of Ramona Enterprises, said it best, “Owning a business means working 80 hours a week so you can avoid working 40 hours for someone else.”

The irony is you’ll actually want to work harder when you understand everything in your business belongs to you. Even the irritating, frustrating, and frightening challenges will take on a new perspective when you realize you also own theopportunities you turn them into. You’ll turn the lights on in the morning and off in the evening not because you want to work more, but because you won’t want to miss any part of your entrepreneurial dream coming true.

Myth 3: When I own my own business, I can take a day off whenever I want.

Well, maybe. However, you may find that your business has such a compelling attraction that you won’t want to take off. Indeed, it’s more likely that whatever interests you had as an employee will become jealous of your business.

Myth 4: When I own my own business, I’ll make a lot of money.

If the only reason you want to own a business is to get rich, you probably won’t be a happy owner. It’s true – you actually could get rich, but it’s more likely that you’ll just make a living.

Being a successful business owner first means loving what you do. Pursuing wealth should be secondary and ironically is actually more likely to happen when in this subordinate role.

Write this on a rock … For maximum small business success, don’t fall prey to the myths of ownership.

AUDIO: The cost of not converting to Age of the Customer practices

What does it cost to reject The Age of the Customer shift? Jim Blasingame reveals that the only thing that costs more than converting to Age of the Customer practices is not converting.

Click the image to begin the audio.

Connecting with global prospects and getting paid

This is the second of two articles on small businesses going global.

In the first article, I allowed that it can be exciting for business leaders to imagine a global prospect base of more than seven billion people. But for a small business to imagine an export strategy, it’s at once exciting and intimidating because of the three elemental global business questions, the first of which we focused on last time: Who are my global prospects? Now let’s focuses on the other two: How to connect with them and how to get paid.

In the first article, I allowed that it can be exciting for business leaders to imagine a global prospect base of more than seven billion people. But for a small business to imagine an export strategy, it’s at once exciting and intimidating because of the three elemental global business questions, the first of which we focused on last time: Who are my global prospects? Now let’s focuses on the other two: How to connect with them and how to get paid.

The good news is that there are two government agencies standing by to answer both of these questions. Each one provides digital information, human assistance and global networks designed to help a small business maximize its opportunity to create and execute a successful export strategy.

The, “How do I connect with global prospect?” question can be answered by the U.S. Commercial Services, a division of the U.S. Department of Commerce. This should be your first stop for education on finding and converting global prospects into customers.

When you consider all of their resources, the U.S. Commercial Service is a virtual one-stop shop for developing and executing a small business export strategy: a great website (Export.gov); a toll-free number (800-872-872) answered by a real person; over 100 offices around the U.S., plus dozens more around the globe you can walk right into and ask for help; and their book, “A Basic Guide to Exporting,” includes an excellent tutorial and several case studies.

All of that help is free, with the exception of the book and any direct expenses incurred on your behalf.

Export-Import Bank of the United States (ExIm.gov) can answer the “how do I get paid” question on many levels.

Part of the U.S. government, Ex-Im Bank will assist with the financial elements of your export sale. They will working with the banks on both sides of the transaction to coordinate funds transfers, provide loan guarantees, and even pre-delivery working capital for you and post-delivery financing for your customer.

For generations, big firms have owned the franchise on global business. But shifts in technology and demographics are making the global marketplace more compelling and feasible for small businesses.

Contact these two organizations and let them help you develop a global business strategy.

Write this on a rock…The global marketplace – and 7 billion prospects – are waiting for you.

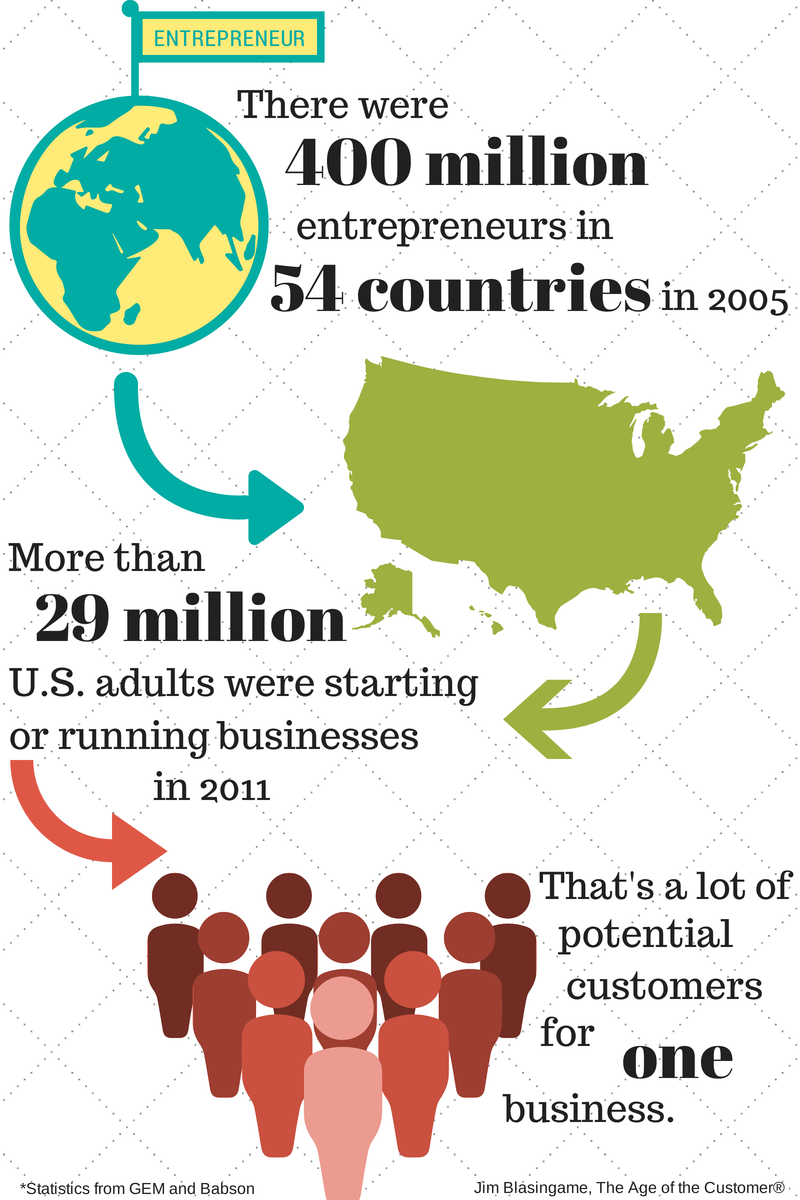

Identifying your small business global prospects

In case you haven’t heard, the seven billionth Earthling was born recently.

For the global marketplace, seven billion prospects are exciting. But for growing American small businesses, 96% of those folks live outside the U.S.

Once, small business growth meant expanding to the next county. But in the 21st century, shifts in technologies and demographics have made expanding outside America’s four-walls increasingly compelling. But it has also produced three elemental global business questions: Who are my prospects, how do I connect with them and how do I get paid? Let’s focus on the “Who” first, with these global stats from National Geographic (January 2011), plus my editorializing.

Nineteen percent of Earthlings are Chinese, 17% are Indian and 4% are American. By 2030, the first two will invert.

Nineteen percent of Earthlings are Chinese, 17% are Indian and 4% are American. By 2030, the first two will invert.- By gender, males barely edge out females: 1.01 to 1.0. But my demographic experts report wide swings in median age among countries, which must factor in any export strategy.

- In a historical shift, just over half of Earthlings are now urbanites. Remember, city folk use different stuff than their country cousins.

- Here are global workplace profiles: 40% of us work in services, 38% in agriculture and 22% in industry. This means different things to different industries, but it means something to all businesses.

- English is the international language of business, but is the first language of only 5% of global prospects. When doing business outside the U.S., be culturally sensitive and patient with the translation process.

- Breaking news: 82% of your global prospects are literate. If you can read and write you can improve your life, which explains the growth of the middle class in emerging markets. A growing global middle class means more affluent consumers.

- Computers are luxuries for most Earthlings. But cell phone usage is exploding across the globe and billions who never owned a PC, or used the Internet, will soon do both with a smart phone. Two words, Benjamin: global mobile.

Even though India and China are much in the news, American small businesses should consider export opportunities in our own hemisphere first, especially where trade agreements are in place, like Canada, Mexico, Panama, Colombia and Chile.

In the next article we’ll address the other two elemental questions: How to connect with global prospects and how to get paid.

Write this on a rock… Consider business growth outside of America’s four walls.

The Blasingame Small Business Banking Rule of Thumb

For many years, I’ve made recommendations to small businesses with regard to their banking relationships called: The Blasingame Small Business Banking Rules-of-Thumb:

1st Blasingame Small Business Banking Rule-of-Thumb

A small business should have at least two banking relationships. If you’re turned down for a loan at one bank, you have another place to go where the person already knows about you and your business. One primary reason for this rule is because if only one banker knows you and your story, when he or she gets fired, promoted or otherwise leaves the bank, Murphy’s Law will dictate that it will happen when you most need a favorable banker.

2nd Blasingame Small Business Banking Rule-of-Thumb

At least one of the banking relationships should be with an independent community bank – that means locally owned and managed – and preferably your lead bank. I’m not picking on big banks, it’s just that most small businesses need to be given a little extra consideration for their character and past performance, which is typically not as forthcoming in a large bank.

Loan decisions made by large banks have two elements that may not give a small business this extra consideration:

1) The actual decision is made by a loan committee in another city, by people who probably don’t know the business owners

2) They rely heavily on what is called “credit scoring,” which is a computer program – each bank has its own proprietary model – that receives quantifiable information and produces a numerical “score”. If this week the bank has decided only scores of 18 or more are accepted, a loan request under 18 will likely be rejected. I’ve never heard of a credit scoring system that includes a variable for the applicant’s character.

Over the years, my Rules-of-Thumb have proven to be valuable to many small businesses. But since 2008, with all of the problems associated with big banks, those who have followed my advice were much less likely to find themselves without access to credit. This was because every independent community banker I spoke had emphatically said they had never stopped lending to their small business customers.

Recently, I talked with two presidents of independent community banks about working with small businesses and the health of the banking industry. First, Mike Menzies, who is not only the president of the Easton Bank and Trustin Easton Maryland, but he’s also the new Chairman of the Independent Community Bankers Association (ICBA). Mike’s also a long-time member of my Brain Trust. Secondly, there is Charles Antonucci, President of Park Avenue Bank in mid-town Manhattan.

They agreed with my advice.